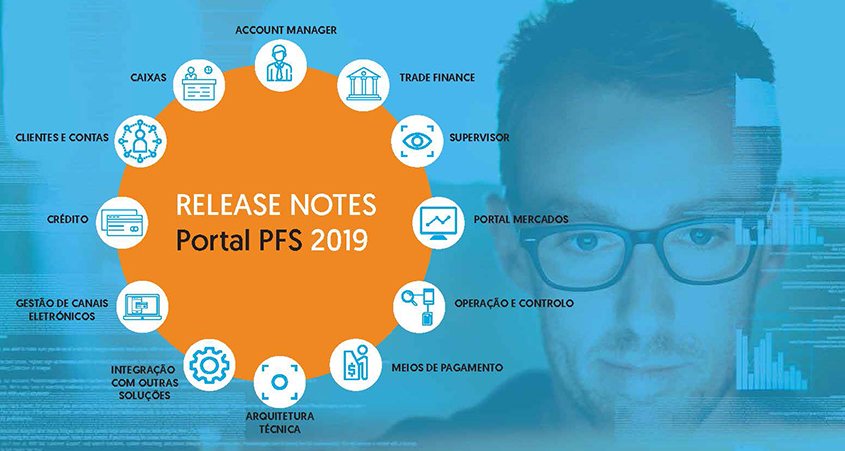

Launch of the PFS 2019 Portal version

In the ongoing evolution of the PFS Portal product, we announced the launch of the PFS 2019 Portal version, which marks an important step in product evolution, providing a set of new business functionalities and techniques.

Committed to the continued evolution of the PFS Portal, Asseco PST has just released an updated version of the product. The new PFS 2019 Portal marks an important step in the evolution of this platform, providing a set of new business functionalities and techniques that will allow for

Along with this evolution, there is a new approach in the diffusion of new functionalities and improvements, with the information structured by module or functional group of the product.

For a better understanding of the various components of the platform, here is a brief description of the items that comprise it:

- Account Manager: It is a solution

specialised in the management of banking accounts of financial institutions. - Cashiers: Provides a set of features related to the operations of a cashier in a banking institution.

- Customers and Accounts: The Customers and Accounts component contains all the basic functionalities of the retail business of a banking institution.

- Credit: Includes management of the life cycle of credit operations, simulation, approval, hiring, reimbursement management, restructuring, associated guarantees and evolution of non-compliance. Coverage through various product modules such as housing, consumption, treasury, investment

and leasing / AML. - Electronic Channels Management: It provides functionalities associated with the management and maintenance of remote banking contracts.

- Integration with Other Solutions: The PFS Portal allows integration with other Asseco PST applications, allowing its users to have a centralized and integrated view, both in relation to the banking client and in the process management.

- Technical Architecture: The Technical Architecture component comprises all the technical functionalities transversal to the PFS Portal.

- Payment Methods: It allows the management of the billing and payment processes carried out in the clearing systems, cards, transfers, cheques, direct debits

and host-to-host payments. - Operation and Control: It provides a set of functionalities related to the control of branch and day-to-day operations carried out by the Bank operator.

- Markets Portal: Includes processes related to the various types of financial markets: Foreign Exchange Market, Money Market, Capital Market

and Derivatives Market. - Supervisor: The Supervisor component of the PFS Portal allows the

parametrisation of the application and the available processes. - Trade Finance: This component provides the functionalities associated with the management of operations in the foreign area, also known as Trade Finance.